Real Estate Market Trends Data are the backbone of informed decision-making across buyers, sellers, investors, lenders, and policymakers. This guide dives into what Real Estate Market Trends Data mean, how to collect and interpret them, and how to apply insights to strategy, pricing, and risk management. By leveraging Real Estate Data Scraping techniques, building robust Real Estate Datasets, and partnering with trusted sources like ScraperScoop, professionals can transform raw numbers into actionable intelligence that drives profitable outcomes.

Understanding Real Estate Market Trends Data

At its core, Real Estate Market Trends Data track how property values, demand, supply, and performance indicators change over time across locations, property types, and market segments. These data provide a lens into the health of the housing market, the evolution of neighborhoods, and the likely trajectory of rents, mortgage rates, and development activity. A well-curated dataset enables analysts to answer questions such as: Which ZIP codes are appreciating fastest? How long do listings stay on market during different seasons? Are rental yields rising in urban cores or suburban peripheries?

Key components of Real Estate Market Trends Data include time-series price indices, inventory levels, days-on-market, rent growth, vacancy rates, mortgage rates, financing availability, construction activity, and absorption rates. When paired with demographic and economic context—employment growth, wage trends, population migration—these data yield powerful insights for forecasting and scenario planning.

Why Real Estate Market Trends Data Matters

For stakeholders across the real estate spectrum, access to accurate market trends data supports better decisions and risk mitigation. Investors use trend data to time acquisitions, exits, and portfolio rebalancing. Lenders rely on housing market indicators to calibrate risk, set reserves, and price loan products. Real estate professionals, developers, and property managers leverage trend data to price listings, optimize marketing, and plan capital expenditures. In sum, Real Estate Market Trends Data helps translate historical performance into evidence-based expectations for the future.

Beyond individual deals, market trends data contribute to macro-level planning—urban development strategies, infrastructure investments, and housing policy. When data are transparent, well-documented, and timely, communities gain visibility into supply constraints, affordability challenges, and growth opportunities. This is where the role of Real Estate Data Scraping, thoughtful Real Estate Datasets, and trusted platforms like ScraperScoop comes into play, ensuring the data underpinning decisions is comprehensive and up-to-date.

Sourcing Real Estate Data: Real Estate Data Scraping, Real Estate Datasets, and Standards

Building reliable Real Estate Market Trends Data starts with sourcing. The landscape includes public records, MLS databases, government statistics, property tax rolls, corporate listings, and rental platforms. To convert these sources into usable information, professionals often rely on Real Estate Data Scraping and curated Real Estate Datasets that emphasize accuracy, freshness, and provenance.

Data Sources and Real Estate Data Scraping

- Public property records and assessor data for ownership, tax assessments, and property characteristics.

- MLS listings and transaction histories for sale velocity, pricing, and market depth (where accessible).

- Rental platforms and occupancy data for rent trends, vacancy, and yield analysis.

- Government datasets on construction permits, zoning changes, and new development activity.

- Economic indicators (employment, wages, consumer confidence) that influence housing demand.

- Geospatial data for neighborhood-level context, walkability, and amenity access.

Real Estate Data Scraping refers to the process of programmatically extracting data from multiple sources to assemble comprehensive datasets. When executed responsibly, scraping respects terms of use, robots.txt, rate limits, and privacy considerations. Scraped data should be validated, deduplicated, and enriched with metadata to support reproducibility and auditability of insights.

Real Estate Datasets and Data Provenance

Real Estate Datasets are curated collections of attributes that describe properties, markets, and performance over time. Reliable datasets emphasize:

- Data provenance: origin, collection date, and versioning so users know where each data point came from.

- Consistency: standardized field names, units, and encoding across sources.

- Completeness: minimization of missing values and transparent handling of gaps.

- Timeliness: clear update schedules and latency disclosures.

- Quality controls: validation rules, anomaly detection, and manual review where appropriate.

Leaders in the space, including ScraperScoop, emphasize building datasets that balance breadth (coverage across markets) with depth (rich property attributes, transaction history, and time series). This balance enables more precise analytics and credible forecasting.

Ethics, Compliance, and Best Practices

Ethical data practices are essential. Always respect intellectual property, user agreements, and privacy constraints. Maintain audit trails for data transformations and document any limitations or biases within the data. When sharing insights or datasets, provide clear disclosures about sources, coverage, and update frequency. The result is trustworthy Real Estate Market Trends Data that analysts can defend in investment committees, lending review boards, and regulatory conversations.

Analyzing Market Trends: Key Metrics to Track

To extract meaningful insights from Real Estate Market Trends Data, focus on a core set of metrics, and then layer in advanced analytics as needed. The following metrics frequently drive robust market intelligence.

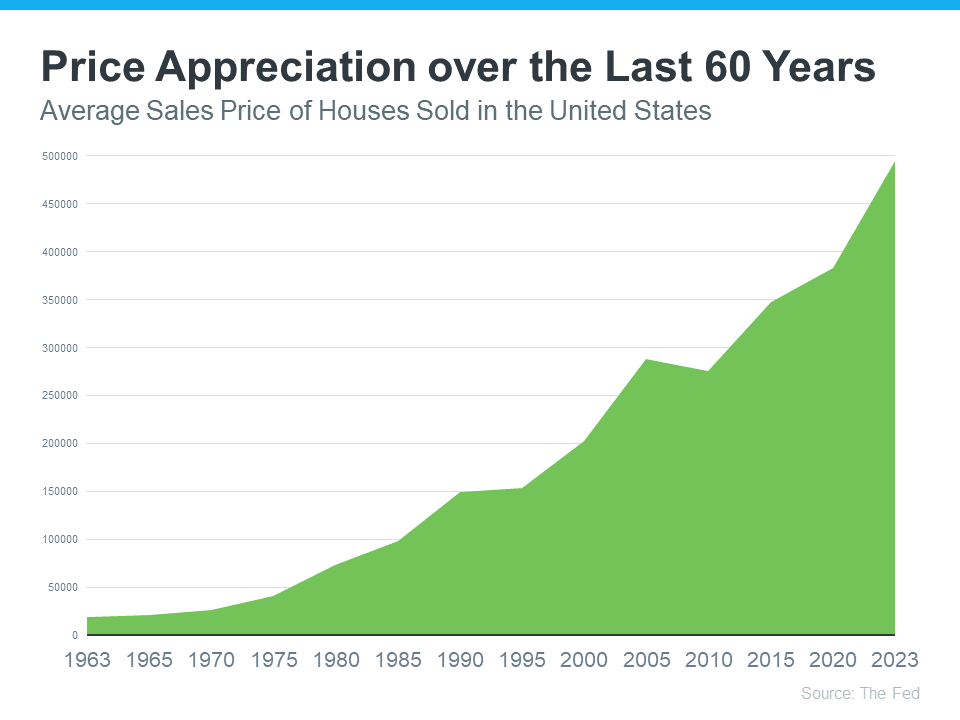

Price Appreciation, Depreciation, and Compression

Track annual and quarterly price changes by market, property type, and neighborhood. Price appreciation signals demand strength, while depreciation can indicate cooling markets or supply shocks. Price compression—narrowing bid-ask spreads and faster alignment of listing and sale prices—offers early warning of market stiffness or change in buyer sentiment.

Inventory, Absorption, and Days on Market

Inventory levels reveal supply conditions, while absorption rates show how quickly new listings convert to sales. Days on market (DOM) indicates market speed and buyer competition. Together, these metrics illuminate whether a market is inventory-constrained, balanced, or oversupplied, guiding pricing strategies and timing for listings or exits.

Rent Growth, Vacancy, and Yield

Rental markets respond to both macroeconomic trends and local supply dynamics. Positive rent growth coupled with healthy occupancy indicates strong cash flow, while rising vacancies may foreshadow softening demand. Yield, or capitalization rate, helps investors compare asset classes and geographies on a risk-adjusted basis.

Financing Conditions: Mortgage Rates and Credit Availability

Financing conditions shape demand by affecting affordability. Tracking mortgage rates, loan-to-value ratios, debt-to-income thresholds, and underwriting standards helps explain shifts in buyer activity and price momentum. When rates rise, demand may soften unless supported by wages, demographics, or supply constraints.

Seasonality and Geographic Variations

Real estate markets exhibit seasonal patterns and geographic heterogeneity. An effective analysis compares month-to-month changes, controls for seasonality, and highlights regions where structural changes (new transportation, zoning reforms, or major employers) alter the baseline trend.

Practical Use Cases for Real Estate Market Trends Data

Real-world applications of market trend data span multiple roles and objectives. Here are some representative use cases that demonstrate value across the decision lifecycle.

Investors and Portfolio Management

Investors use market trends data to identify growth corridors, time entry and exit points, and optimize cap rates. By combining price trajectories with rent growth and occupancy trends, they assess risk-adjusted returns and plan portfolio diversification across asset types (residential, multifamily, commercial).

Lenders and Credit Underwriters

For lenders, market trends data supports risk-based pricing, follows the health of collateral markets, and informs reserve strategies. Dynamic dashboards that monitor regional price momentum, vacancy shocks, and financing conditions help underwrite loans with a forward-looking lens.

Real Estate Agents and Brokers

Agencies rely on timely trend insights to price listings competitively, forecast market windows, and craft narratives for clients. Market trend data enhances listing strategies, benchmarking, and client education on price trajectories and timing.

Developers and Asset Managers

Developers evaluate supply pipelines, zoning outcomes, and demand forecasts to plan new projects. Asset managers use trend data to optimize property performance, plan value-add strategies, and schedule capital expenditures aligned with market cycles.

How to Leverage ScraperScoop for Real Estate Market Trends Data

ScraperScoop offers a range of capabilities designed to accelerate the collection, cleaning, and deployment of Real Estate Market Trends Data. Integrating these capabilities can yield faster time-to-insight and higher data quality.

- Curated Real Estate Datasets: Access comprehensive datasets that cover property attributes, transactions, rents, and market indicators across multiple regions.

- API Access and Automation: Programmatic access to data feeds enables seamless integration into dashboards, models, and reporting pipelines.

- Data Cleaning and Normalization: Built-in pipelines normalize fields (currency, dates, units), deduplicate records, and flag anomalies for review.

- Versioning and Provenance: Track data versions and source lineage to ensure reproducibility of analyses and compliance with audit requirements.

- Update Frequency and Freshness: Choose refresh cadences to balance relevance with processing costs, ensuring you stay current on market shifts.

- Visualization and Analytics Support: Pre-built templates and customizable dashboards help translate numbers into story-driven insights for stakeholders.

- Ethical and Compliant Practices: Adheres to data-use policies, rate limits, and privacy considerations to maintain trust with data partners and clients.

By leveraging ScraperScoop, analysts can accelerate the pipeline from raw data to decision-ready insights, ensuring that Real Estate Market Trends Data remain timely, relevant, and credible for strategy and reporting.

Best Practices for Working with Real Estate Market Trends Data

To maximize value, apply disciplined data practices, robust analytics, and clear communication of insights. The following best practices help maintain quality and usefulness across teams and stakeholders.

Data Cleaning and Normalization

– Normalize currency formats, date-time stamps, and property attributes across sources.

– Implement deduplication routines to avoid double-counting properties or transactions.

– Validate critical fields (price, date, location) against known ranges and rules.

– Maintain a data dictionary that describes each field, its source, and any transformations.

Visualization and Reporting

– Use time-series charts to display price, rent, and inventory trends with clear indications of seasonality.

– Build geospatial dashboards that map market performance by city, neighborhood, and property type.

– Include confidence intervals, data freshness indicators, and source notes in dashboards to set expectations.

Data Governance and Compliance

– Document data sources, licensing terms, and any redistribution restrictions.

– Establish access controls and data usage policies for internal teams and external clients.

– Periodically audit data pipelines for accuracy, latency, and policy compliance.

Getting Started: Steps to Build Your Real Estate Market Trends Dashboard

Below is a practical, phased approach to creating a market trends dashboard that centers Real Estate Market Trends Data in decision-making.

- Define objectives: Clarify what decisions the dashboard will support (pricing, introductions of new listings, risk monitoring, portfolio allocation).

- Identify data sources: Compile a list of trusted sources for Real Estate Data Scraping and determine licensing or usage constraints.

- Assemble Real Estate Datasets: Combine property attributes, transactions, rents, and macro indicators into a cohesive dataset with consistent schema.

- Data cleaning and enrichment: Normalize fields, handle missing values, and enrich with geographic and socio-economic context.

- Model and analyze: Apply time-series analyses, regression, or machine learning as appropriate to forecast prices, rents, and demand indicators.

- Design the dashboard: Create intuitive visualizations, filters by location, property type, and time window, and ensure accessibility.

- Test and validate: Compare dashboard outputs with known benchmarks, perform backtesting on historical periods, and gather stakeholder feedback.

- Deploy and monitor: Publish dashboards, set data refresh cadence, and implement alerting for significant market shifts.

- Iterate: Regularly update data sources, refine models, and expand coverage to new markets as needed.

Case Study: Using Real Estate Market Trends Data to Navigate a Market Shift

Consider a market experiencing rising mortgage rates and constrained inventory. A robust Real Estate Market Trends Data workflow would reveal slower price appreciation, longer DOM in specific neighborhoods, and rising rents in others where occupancy remains strong. By comparing regional dashboards and adjusting assumptions in forecasting models, a developer might shift to projects in high-demand, under-supplied areas, while an investor could adjust hold periods and financing strategies. This is the power of integrating Real Estate Data Scraping, Real Estate Datasets, and insights from ScraperScoop into a cohesive decision framework.

Common Pitfalls and How to Avoid Them

Even with rich data, analysts can encounter challenges. Here are common pitfalls and practical mitigation steps:

- Over-reliance on a single source: Diversify data inputs to reduce bias and gaps.

- Ignoring data quality: Prioritize validation, provenance, and transparent limitations.

- Underestimating timing: Align data refresh cycles with market volatility for timely insights.

- Failing to communicate uncertainty: Include confidence intervals and scenario ranges in reports.

Frequently Asked Questions (FAQ)

Q: How often should Real Estate Market Trends Data be updated?

A: Update frequency depends on market dynamics and data source capabilities. For fast-moving markets, bi-weekly or weekly updates are common; for slower markets, monthly updates may suffice.

Q: What is the difference between Real Estate Market Trends Data and raw listings data?

A: Market trends data aggregate and harmonize multiple sources to reveal patterns over time, while raw listings data provide current or historical property-specific information, which may require normalization to enable cross-market comparisons.

Conclusion: Turning Data into Decisions

Real Estate Market Trends Data empower stakeholders to anticipate shifts, optimize investments, and communicate market narratives with confidence. By combining rigorous data collection through Real Estate Data Scraping, thoughtful Real Estate Datasets, and trusted platforms like ScraperScoop, professionals can build a foundation for accurate forecasting, strategic pricing, and resilient portfolio management. Embrace a disciplined approach to data quality, maintain transparency about sources and limitations, and continuously refine models to stay ahead of the curve.

Call to Action

Ready to elevate your market intelligence? Explore ScraperScoop’s Real Estate Datasets and APIs to start building your Real Estate Market Trends Data-powered dashboards today. For a hands-on demonstration, contact our team to request a sample dataset and a tailored data plan that fits your market priorities.

Explore ScraperScoop’s Real Estate Datasets

Ready to unlock the power of data?