Introduction

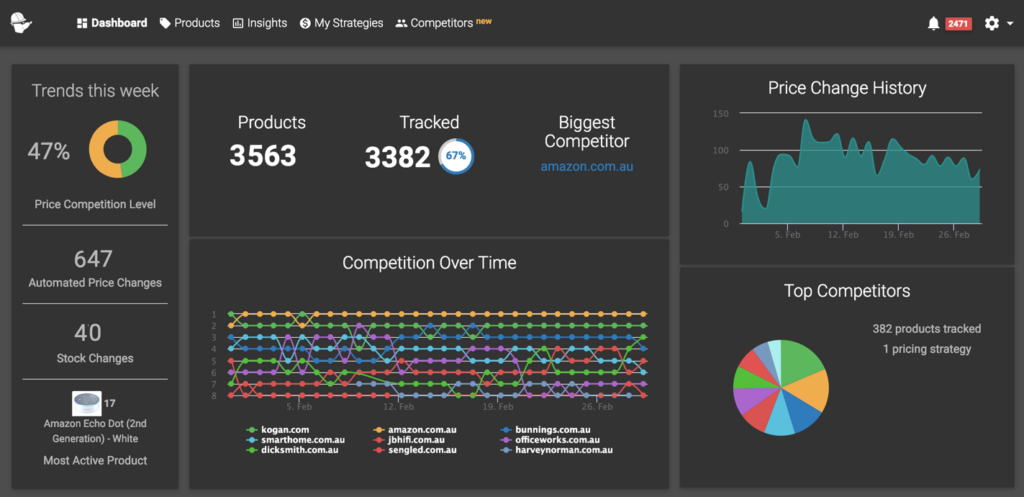

Pricing in 2025 is no longer static.

If your price stays the same for even 24 hours, you risk:

- Losing visibility

- Dropping rankings

- Missing conversions

That’s why competitor price monitoring has become a must-have strategy.

Why APIs Don’t Work for Price Monitoring

Most marketplaces:

- Don’t expose competitor prices via APIs

- Limit request volume

- Hide discounts and seller data

So how do brands track prices?

👉 Web-based datasets and scraping.

What Price Monitoring Data Includes

- Product price

- Discount percentage

- Seller name

- Stock status

- Rating & reviews

- Delivery timelines

This data is captured hourly or daily for accuracy.

Manual Tracking vs Automated Data

| Method | Accuracy | Scale | Speed |

|---|---|---|---|

| Manual checks | Low | Very limited | Slow |

| Spreadsheets | Medium | Limited | Slow |

| Automated datasets | High | Large | Real-time |

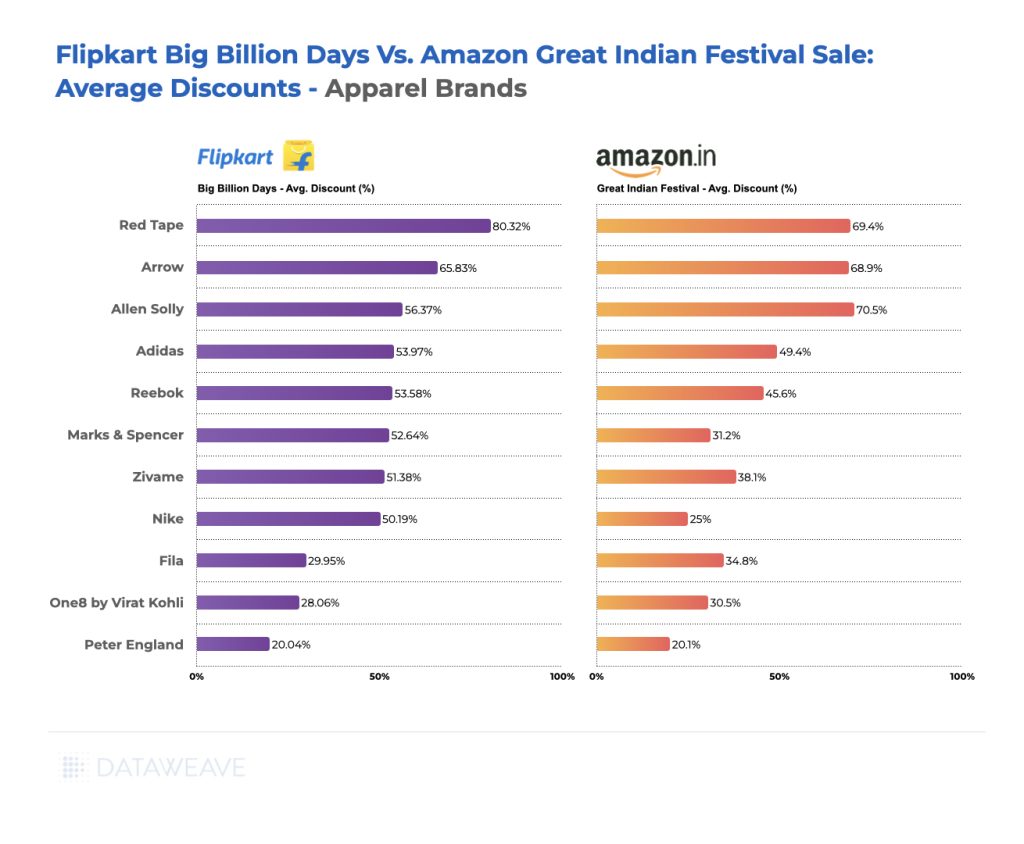

Real-World Example

A mid-size Amazon seller:

- Tracked 500 SKUs automatically

- Adjusted prices every 3 hours

- Increased sales by 41%

- Reduced ad spend by 18%

All using competitor pricing datasets.

Who Uses Price Monitoring Data?

- Amazon & Flipkart sellers

- D2C brands

- Pricing analysts

- Market research firms

- AI pricing tools

FAQs

Is price scraping allowed?

Yes, when scraping publicly visible prices responsibly.

How often should prices be tracked?

During sales: every 1–3 hours.

Normal days: daily.

Can small sellers use this?

Absolutely — datasets scale to any size.

Conclusion

In competitive markets, pricing is strategy.

Brands that monitor competitor prices win visibility, conversions, and margins.

Start Competitor Price Monitoring Now!

Ready to unlock the power of data?