Your competitor just dropped their price on your best-selling product by 12%. How long until you know about it? An hour? A day? Next week when your sales mysteriously drop?

Here’s what’s happening right now while you’re reading this: major retailers are scraping competitor prices every 15 minutes, automatically adjusting their own pricing, and capturing sales that should have been yours. They’re operating with intelligence you don’t have—and it’s costing you money every single day.

Price monitoring through web scraping has become the secret weapon of e-commerce winners in 2025. It’s not optional anymore—it’s survival. And the best part? The technology is no longer just for Amazon and Walmart. Small and medium-sized retailers are now using these same techniques to level the playing field.

The Price War is Real—And You’re Already In It

Let me hit you with some numbers that should wake you up. Studies show that 81% of online retailers now use web scraping for price intelligence. That’s not a niche tactic—that’s industry standard. If you’re not doing it, you’re literally competing blind.

The impact is massive. Retailers using automated price monitoring report an average 18-25% increase in profit margins. Not revenue—actual profit. That’s because they’re not guessing at optimal prices; they’re using real-time competitive data to price products at exactly the sweet spot where they maximize both volume and margin.

Why Manual Price Checking Doesn’t Work Anymore

I talked to an e-commerce manager last month who had an intern manually checking competitor prices for their top 50 products twice a week. They spent 4 hours each session, creating spreadsheets that were outdated by the time they finished. Sound familiar?

Here’s the problem: prices change constantly. During Black Friday, major retailers adjust prices every few hours. In competitive categories like electronics, prices fluctuate multiple times daily. Manual monitoring can’t keep up, which means your pricing decisions are based on stale data.

Automated web scraping solves this by monitoring thousands of products across dozens of competitors continuously. You get alerts within minutes when important price changes happen. No manual work required.

How Price Monitoring Web Scraping Actually Works

The technical side sounds complicated, but the concept is simple. Your scraper visits competitor websites automatically, extracts current prices, compares them to historical data, and alerts you to changes or opportunities.

The Core Components

Product Matching: First, you need to identify which of your products correspond to competitor products. This can be tricky because product titles, SKUs, and descriptions vary across sites. Modern scrapers use AI to match products based on features, images, and specifications—not just names.

Price Extraction: The scraper navigates to product pages and extracts the current price. Sounds easy, but websites display prices in different formats, currencies, and locations. You need scrapers that can handle crossed-out original prices, discounts, bulk pricing, and shipping costs.

Historical Tracking: Current prices mean nothing without context. Your system needs to track price history over time, identifying patterns like when competitors typically raise or lower prices, how long sales last, and seasonal pricing trends.

Alert Triggers: Not every price change matters. Configure alerts for significant events like when a competitor undercuts your price by a certain percentage, when products go on sale, when new competitors enter the market, or when average market price drops below your cost.

Automated Response: The most sophisticated systems don’t just alert you—they automatically adjust your prices based on predefined rules. If Competitor A drops below your price, your system can respond within minutes.

Building a Winning Price Intelligence Strategy

Having the technology isn’t enough. You need a strategy that turns data into profit. Here’s how successful retailers approach price monitoring:

Identify Your Competitive Set

Don’t try to monitor every competitor in existence. Start with your top 5-10 direct competitors—the ones your customers actually comparison shop against. Use tools like SimilarWeb or ask your customers where else they shop.

Also consider marketplace aggregators. If you’re selling products that appear on Amazon, eBay, or Walmart Marketplace, you need to monitor those platforms. Customers often use them as price benchmarks even if they prefer buying directly from you.

Segment Your Products by Strategy

Not all products should use the same pricing approach. Categorize your catalog into segments with different strategies:

Loss Leaders: These are products where you want to be the cheapest to drive traffic. Monitor competitors closely and be willing to match or beat any price, even at thin or negative margins. You’ll make money on other purchases in the basket.

Profit Drivers: Your high-margin products where you have differentiation. Monitor prices but don’t race to the bottom. You can command premium pricing if you offer better service, faster shipping, or unique bundles.

Stock Clearance: Products you’re trying to move quickly. Here, being competitive matters more than maintaining margin. Use scraped data to price just below market average.

Exclusive Items: Products only you carry. Still monitor similar items to understand what customers expect to pay, but you have pricing power here.

Dynamic Pricing Rules

Set up rules that automatically adjust prices based on competitive intelligence. For example, maintain a 5% discount compared to the average of your top 3 competitors for loss leaders; price 10% higher than the market average for exclusive items where you can justify premium value; match the lowest competitor price for commodity products; or protect minimum margins by never pricing below cost plus 15% regardless of competition.

These rules let your system make pricing decisions automatically while you sleep, ensuring you’re always competitively positioned without manual intervention.

Real-World Success Stories

Let me show you how real businesses are winning with price monitoring:

Electronics Retailer: 23% Margin Improvement

A mid-sized electronics retailer was losing sales to larger competitors but didn’t know why. After implementing price monitoring, they discovered they were consistently overpricing popular items while underpricing accessories where they had room for margin.

They implemented dynamic pricing with specific rules: match or beat competitors on flagship products like laptops and phones, price accessories 15-20% above market average (customers don’t comparison shop on cables), and bundle high-margin items with loss leaders.

Six months later, revenue was up 31%, but more importantly, profit margins improved by 23%. They were selling more while making more per sale—the holy grail of retail.

Fashion Boutique: Inventory Turnover Increased by 40%

A fashion boutique struggled with seasonal inventory that would sit unsold until they had to mark it down dramatically. They started scraping competitor prices for similar styles and monitoring how quickly those competitors sold through inventory.

The insight was eye-opening: competitors marked down seasonal items progressively—small discounts early, larger ones as the season progressed. The boutique had been holding full price too long, then panic-discounting at the end.

By adjusting their markdown strategy based on competitive intelligence, they sold through seasonal inventory 40% faster while maintaining better margins. Less clearance, more profit.

Consumer Electronics Marketplace: Real-Time Competitiveness

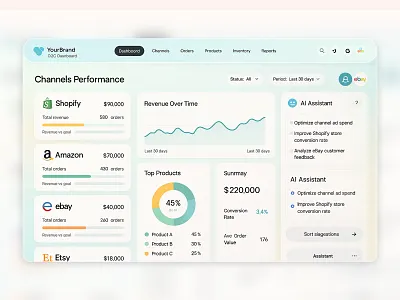

An online marketplace with thousands of third-party sellers implemented price monitoring to help sellers stay competitive. They scraped prices from Amazon, eBay, and direct competitors, then showed each seller where their prices ranked.

Sellers could opt into auto-repricing that would adjust their prices to stay within the top 3 lowest prices for each product. The results were dramatic: sellers using auto-repricing saw 47% higher sales velocity, customer conversion rates improved by 19%, and the marketplace gained reputation as having competitive prices.

Technical Challenges and How to Solve Them

Price scraping has unique technical hurdles. Here’s what you’ll face and how to handle it:

JavaScript-Rendered Prices

Many e-commerce sites load prices dynamically using JavaScript. Traditional HTTP scrapers will miss these prices entirely. You need headless browsers like Puppeteer or Playwright that render the page fully, including all JavaScript. Yes, they’re slower and more resource-intensive, but they’re necessary for modern websites.

Personalized Pricing

Some retailers show different prices to different users based on location, browsing history, or device. Your scraper might see different prices than your customers do. Combat this by scraping from multiple locations using geo-distributed proxies, clearing cookies and using fresh sessions for each scrape, and rotating user agents to simulate different devices.

Track price variations and note when prices differ by location or context. This intelligence itself is valuable—it tells you how competitors are segmenting their pricing strategy.

Rate Limiting and Blocks

E-commerce sites actively try to block scrapers because they don’t want competitors monitoring their prices. Use residential proxies that appear as regular users, implement random delays between requests to mimic human browsing, and rotate user agents and headers to avoid fingerprinting.

If you’re scraping major retailers, expect to invest in quality proxies. Cheap datacenter proxies will get blocked quickly. Residential or mobile proxies cost more but are essential for reliable price monitoring.

Price Format Variations

Prices appear in countless formats across different sites, including dollar signs, commas, decimals, and currency codes. You need robust parsing that can handle all variations and convert everything to a standard format for comparison. Regular expressions and price-parsing libraries are your friends here.

Legal and Ethical Considerations

Let’s address the elephant in the room: is scraping competitor prices legal? The short answer is that it’s generally legal to scrape publicly available pricing information. Courts have consistently held that prices displayed publicly aren’t protected from collection.

However, there are boundaries you should respect. Don’t scrape personal customer data or login-protected prices without authorization. Respect robots.txt files even though they’re not legally binding. Use reasonable request rates that don’t overload competitor servers. Don’t use scraped data to make false claims about competitors.

Most retailers scraping prices do so openly. It’s an accepted competitive practice. That said, I’m not a lawyer, and regulations vary by jurisdiction. If you’re concerned, consult legal counsel familiar with data collection laws in your region.

From an ethical standpoint, price monitoring is simply competitive intelligence. You’re not stealing anything—you’re collecting information that competitors voluntarily display publicly. It’s no different than a store sending someone to walk through a competitor’s physical location and note their prices.

Choosing the Right Price Monitoring Solution

You have several options for implementing price monitoring, each with trade-offs:

Build It Yourself

If you have development resources, building a custom scraper gives you complete control. Use frameworks like Scrapy or Puppeteer, host it on cloud infrastructure, and integrate directly with your pricing systems. This approach offers maximum flexibility but requires ongoing maintenance as websites change.

Expect to dedicate at least one developer part-time to maintain scrapers, handle blocks, and add new competitors.

Use a Price Monitoring Service

Companies like Prisync, Competera, and Intelligence Node offer turnkey price monitoring specifically for e-commerce. You upload your products, they handle all the scraping, and deliver competitive pricing data through dashboards or APIs.

This is the fastest route to value. Costs typically range from $100-$1,000+ per month depending on how many products and competitors you monitor. For most retailers, this is far cheaper than building in-house when you factor in developer time.

Use a Scraping Platform

Platforms like Apify, Octoparse, or ScraperAPI provide tools to build custom scrapers without coding. You get more control than turnkey services but less maintenance burden than building from scratch. Good middle-ground option if you have specific requirements that off-the-shelf solutions don’t meet.

Advanced Price Intelligence Tactics

Once you’ve mastered basic price monitoring, level up with these advanced strategies:

Stock Availability Tracking

Don’t just track prices—monitor whether competitors have products in stock. When a competitor runs out of stock, that’s your opportunity to capture sales even at higher prices. Set up alerts when competitors show “out of stock” or “limited quantity” messages.

Promotional Pattern Analysis

Track when competitors run sales, what discounts they offer, and how long promotions last. Most retailers follow predictable patterns—monthly sales, seasonal clearances, holiday promotions. By analyzing historical data, you can predict when sales are coming and plan your own timing strategically.

Market Basket Analysis

Scrape not just individual product prices but also how competitors bundle products. Are they offering “frequently bought together” discounts? Free shipping thresholds? Bundle deals? This intelligence helps you create more competitive offers.

Review and Rating Monitoring

While you’re scraping prices, also collect ratings, review counts, and sentiment. Products with higher ratings can command premium prices. If your rating is higher than competitors’, you have justification to price above market. If it’s lower, you might need to discount to compensate.

Measuring ROI from Price Monitoring

How do you know if price monitoring is actually working? Track these metrics:

Margin Percentage: Has your overall gross margin improved since implementing dynamic pricing? Track this by product category to see where you’re gaining.

Win Rate: When customers comparison shop, how often do you win? Track this through customer surveys or analytics showing bounce rates from price comparison sites.

Price Competitiveness Score: Calculate what percentage of your products are priced competitively (within 5% of market average). Higher scores correlate with better conversion rates.

Revenue per SKU: Are you selling more of each product? Revenue per SKU should increase as pricing becomes more optimized.

Clearance Reduction: Are you selling through inventory faster, reducing end-of-season clearance? Better pricing throughout the lifecycle reduces markdowns.

Most retailers see positive ROI within 2-3 months of implementing price monitoring. The key is having baseline metrics before you start so you can measure improvement.

The Future of Price Intelligence

Price monitoring continues to evolve. Here’s what’s coming:

AI-Powered Demand Prediction: Future systems will combine price data with demand signals—search trends, social media buzz, weather patterns—to optimize pricing based on predicted demand, not just competition.

Real-Time Everything: Current systems check prices every few hours or minutes. Next-generation systems will monitor continuously, adjusting prices in real-time as competitive landscape shifts.

Cross-Channel Integration: Better integration between online price monitoring and physical retail. Dynamic pricing will extend to in-store displays powered by real-time competitive intelligence.

Collaborative Intelligence: Platforms will emerge where non-competing retailers share anonymized pricing data, creating industry benchmarks that help everyone optimize pricing together.

Taking Action: Your 30-Day Implementation Plan

Ready to implement price monitoring? Here’s your roadmap:

Week 1: Strategy and Planning. Identify your top 20-50 products to monitor initially. Choose 5-10 key competitors. Decide whether to build, buy, or use a platform. Set baseline metrics for margin, conversion rate, and revenue.

Week 2: Implementation. Set up your scraping solution. Configure product matching and price extraction. Test thoroughly to ensure accurate data collection. Start collecting historical data.

Week 3: Rules and Automation. Define pricing rules based on product segments. Set up alerts for significant price changes. Configure automated repricing if using dynamic pricing. Train your team on how to interpret and act on data.

Week 4: Optimization and Expansion. Review early results and adjust rules. Add more products and competitors. Fine-tune alert thresholds. Plan expansion to additional categories.

By the end of 30 days, you should have a working price intelligence system delivering actionable insights. From there, it’s about continuous optimization and expansion.

The Bottom Line

Price monitoring through web scraping isn’t a nice-to-have in 2025—it’s table stakes for e-commerce success. Your competitors are doing it. Your customers are comparison shopping. The only question is whether you’ll compete with data or fly blind.

The technology is accessible. The ROI is proven. The barrier to entry is low. What are you waiting for?

Start small—monitor a handful of products from a few competitors. Prove the value. Then scale. Within months, you’ll wonder how you ever made pricing decisions without this intelligence.

The price war is happening whether you participate or not. The question is: will you compete with weapons or without them?

Start Monitoring Competitor Prices Today

Ready to unlock the power of data?